Introduction

Game theory is the formal study of decision

being made by multiple players must make choices that potentially affect the

interests of the other players. Now, game theory can be used to describe how

football player’s agents and football clubs should maximise their payoff, which

can be defined as the profit or utility (points in the league table), while

cooperating with each other. So, as you may

have guessed by now, I will be focusing on cooperative game theory in

this essay, but we will dip in and out of non-cooperative game theory too as

agents are not paid to be nice. But let us first get a feel for the market of

players to do proper economic analysis.

Market for players

Agents, who represent both the players and the

club’s interest, are the sellers in this market. Their incentive is to maximise

the transfer fee and the agreed salary of the player as the agent gets a cut

from the year’s wages and a slice of the transfer fee paid for the player’s

services. They also have to think about sponsors. The agent needs to

negotiate the split between the club and the player on the fees earned by

sponsors, and this is especially important for star players. Football agents

have a key role to play in increasing the financial power currently experienced

by footballers. For example, due to a good season for his club, a player’s market

value goes up so his agents will often use this as a bargaining tool to

engineer a new contract for that player despite not being anywhere near the end

of his previous contract. Football player’s contracts can last for a total of

five years but are often renewed after only two years in order to increase the

wages paid to that player – this is a key example of player power.

The Price Elasticity of Demand is low for

football players, especially in the premier league, although the

elasticity varies depending on the club. The richest clubs usually have

higher reservation price for the player they target, and their PED is usually

inelastic as they are keen to improve their team. For example, in 2015,

Manchester City paid £49 million for Raheem Sterling in 2015,

while Leicester City paid £375,000 for Mahrez in 2014. Mahrez was one

the top goal scorer for Leicester with 19 goals and 11 assists, while Sterling exhibited

a relatively meagre performance of 11 goals and 4 assists (and then helped

England exit Europe). So obviously, the utility derived by Leicester (which

went on to win the latest premier league, partly due to the magic of Mahrez)

was much higher than that of Manchester City, though his initial prize was much

lower.

[i]Transfer fees serve to prevent a total barrier for players’ mobility.

Free movement of players is restricted under transfer rules so that there is a

fair and balanced competition. This is so that clubs experiencing a string of

success are not able to attract the suddenly best players in the league and drain

their competitors.

Game theory in

negotiation of transfer fee

When we

use game theory in economic analysis, we assume these things:

·

Players

or parties rational beings.

·

Players

have the intention to maximize their utility/outcome.

·

Players

will accept the highest payoffs (profit or utility).

·

Players

know the "rules of the game.", which means that they have full

knowledge on how the game is operating

·

Players

assume other parties to be fully rational.

·

The

number of players is fixed and known to all parties.

·

Each

party recognizes a set of available options and develops tangible preferences

among those options. Preferences remain constant throughout the

conflict/negotiation interaction.

·

Each

party knows or can estimate well the options and preferences of the other

parties.

·

Communication

is limited, highly controlled, or not relevant to the conflict/negotiation

interaction.

·

A

decision must be possible that is maximally efficient, i.e., intersects with

the solution set at a point that maximizes each party's own interests (so too

create a pareto optimal, which is the allocation of resources in a way so that it

is impossible for one individual to be better off without making at least one

individual worse off).

Now,

let us imagine a black box. Imagining this black box is important as it

represents the apparatus of the legal system (set by completely reliable and

controversial-free regulatory bodies like FIFA), and we have to assume that

there is cooperation as the both sides of the table could get sued if they

don’t live up to their side of their bargain. So from the the following

discussion, we are going to imagine the existence of this black box so that we

can simplify the problem at hand.

The simplest two-person game

Usually when we think of

negotiations, we imagine two people facing off against each

other. Whatever one wins, the other loses the same amount. So,

in regards to the question, in the negotiations the player’s agent wants

to maximise his/her compensation and the buying club wants to minimise the

fee it offers for the player.

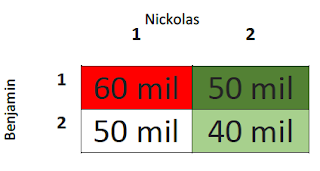

In the following example, let’s

say Nickolas is the manager of Jamie’s Angels F.C., and is negotiating

the transfer Dmitri Lafayette from City Hawks and they have to agree on

how much JAFC will pay for Lafayette with his agent, Benjamin. They

each have two strategies available to them, but the outcome is not just dependent

on the strategy chosen, but also on what their opponent does. So while Nickolas

would obviously choose to pay the minimum (£40,000,000) and Benjamin would like

to have the maximum (£60,000,000), the opposing move needs to be taken into

account before an optimal strategy can be selected.

As the title of this

section might suggest, this game might be the simplest negotiation scenario we

could think of. The minimax theorem would tell us that these rational agents of

economic force should pick the strategy where the maximum advantage of their

opponent is minimized. So, in the above example, Nickolas should pick strategy

#2 to pay 10 less unit (a unit being 10 million) while Benjamin should pick

strategy #1 to avoid only getting paid 40 million.

The Minimax theorem is

a simple but useful as it can be can be applied to everyday situations.

However, it’s problematic partly because it assumes the parties have

access to perfect information. Obviously, real life is much more

complicated, not least because our negotiating opponent is rarely limited

to two strategies.

Let’s see what happens

if we add additional strategic possibilities.

Although

much more complicated, this game is still solvable. It is generally an

advantage to have less options for yourself and more options for

your opponent (although a bit counter-intuitive).

Game theorists achieve

this mathematically by determining which strategies are numerically dominant

and using randomly mixed strategies. During negotiation, the agent or the

buying club would calculate h have a clear idea of what you want and eliminate

inferior options. Your advantage can sometimes be increased if you don’t

announce your preferences to your opponent so that he still has to consider

variables which you don’t.

Nash

bargaining solution

So Lafayette is worth

£60,000,000 (this would be its reservation price, which the highest price a

consumer is willing to offer for a good or service) to the JAFC while the Hawks

would be willing to sell Lafayette for at least £40,000,000. So, how can the

cooperatively share the surplus of £20,000,000 amongst themselves. Now, the

common approach to this problem would be to say that the player would be sold

at £50,000,000, so the surplus is shared equally. However, each side could take

advantage of their positions for a non-equilibrium (or zero sum) outcome to be

produced. It could be that the Lafayette is very eager to move to Jamie’s

Angels so the agent might be under pressure to let a deal go through as quickly

as possible to avoid the risk of losing the transfer. However, if the agent

knows JAFC is desperate for Lafayette and that Lafayette is in high demand,

then he would be willingly to take more risk and demand a higher surplus.

Nash figured out the the set of agreement would be shaped like curved rectangle as Nickolas lie a curved square or a circle as Benjamin and Nickolas would be willingly to take different levels of risk differently, as we can see for figure 3. Another way to look at this would be say that Benjamin and Nickolas have different The Pareto frontier (the line of efficient outcomes) would be across the edge of the possible agreements. We would draw a tangent to the point which is the midpoint of the frontier, and set the slope’s angle to 45°. So the picture is looking quite pretty at the moment.

Let’s

play with some numbers (aha

pun, get it?). Let’s get back to how the two parties value the transfer of Lafayette.

JAFC believes that Lafayette can get them points in the next season if they

bring him in, as he is a top notch goal scorer. This also means that the demand

for Lafayette is very high as he is a very well known player. Due to his

ability to bring points to his team (the extra nine points would most likely

that they would finish second in the league next season) they would get 15

million more from the Premier League, and the revenue from shirts, sponsorship

and increased tickets is estimated to be around 15 million. So, the utility for

buying Lafayette for JAFC would be 30 utils (this an arbitrary unit of utility

defined as £1 million for 1 util). But for every 10 million more they invest

into Lafayette’s transfer from City Hawks asking price, they lose 3 utils. Now,

City Hawks, would be able to afford one extra defender who will give them 2

points each for every 20 million they would earn from the deal. 5 points would

move them one place up in the table from the third place, and they would earn £6

million from every place they move up, which is 6 utils. Now, the two extremes

are that JAFC pays the Hawks £40 million, or that it pays the Hawks £60

million.

·

In the first extreme,

the JAFC gain 30 – 4*3 = 18 utils. Hawks would be able to buy two defenders,

and so it will gain 12 utils.

·

In the second extreme,

the JAFC will gain 30 - 6*3 = 12 utils. Hawks will be able to buy three

defenders, so it would gain 18 utils.

Nash’s bargaining solution is found by

averaging the two extremes. The average gives 15 utils for City Hawks and also 16

utils for Jamie’s Angels. This means the price should be at £50 million. Conveniently,

the artificial numbers in this hypothetical scenario turned out to work so that

the answer came out to be the nice average £50 million, but under different

conditions, the Nash’s bargaining solution would have been the most realistic

way to compute the ultimate transfer fee than finding the average of the

maximum and minimum prices being offered by the negotiators.

Rubenstein’s bargaining method

We have not considered

commitment issues. If, let’s say, Benjamin is intent that he will only accept

at least a bid of £55 million for Lafayette’s, what guarantee would Nickolas

have that this is Benjamin’s lowest asking price. This is a negotiation after

all. Ben and Nick can alternate offers until they reach an agreement. Assuming

that the prefer to make a particular deal now then later, then Rubenstein

showed that there is a sub-game perfect equilibrium. If Nick is more patient

then Ben, his discount rate (the rate at which he decreases his price to sell

Lafayette) would be lower, so he will get a higher portion of the 20-million-pound

surplus. Rubenstein’s model assumes there is perfect information, so both sides

now for sure what each other minimum/maximum offers are. Neither Ben nor Nick know

the most the first is willing to offer and the least the latter is willing to

accept for Lafayette. The issue of commitment means that both parties stand to

benefit from being patient, but due to the nature of the transfer market of the

premier leagues (Lafayette has to be sold during the transfer window), time is

a limited resources and demand for Lafayette is high, so JAFC’s Nickolas would

cannot afford the same patience as Benjamin because delays are costly.

Let’s answer

one final question with game theory about the transfer of players.

Should a football team sell a player?

The club has to calculate the expected value of

selling a player or not to look at this question.

EV(Not sell) = P(Club staying in EPL) x (Total

Revenue from EPL) + P(Relegated) x (Total Revenue from the

Championship) – (Money spent improving the squad)

EV(Sell) = P(Staying in the EPL) * (Total Revenue

from being in the EPL) + P(Relegated) x (Total Revenue from the

Championship) + (Money gained from selling) – (Money spent replacing him)

Note: EV stands for Expected Value

But, the intangible value that a

player can bring to the club should be considered too. For example, Lafayette

brings the City Hawks a loyal fan base who are excited to see their star player

and so are more likely to come frequently to matches. Then, there is also the

morale that the star player Lafayette brings to the changing room and chemistry

on to the field, so that the team is motivated and able to win matches. Considering

these, it might not be such a good idea for a Nickolas to sell Lafayette. If we

quantify these costs as revenue in form of ticket, merchandise and earnings

from winning games, these costs would be the opportunity cost of selling

Lafayette.

Bibliography

Websites

http://www.101greatgoals.com/blog/the-transfer-values-of-the-top-100-players-in-europe-cies-football-observatory/

Books

Game Theory, A very short introduction,

Ken Binmore

Games and Decisions, Luce and Raiffa.

No comments:

Post a Comment